How the unbankable are restoring the blighted blocks of Milwaukee

After twenty years driving buses for the Chicago Transit Authority, James Reynolds moved to Milwaukee to care for his mother in her most fragile final years.

Finding an apartment on a quiet street just off the expressway, James’ rent was $550 and never late. In the fifteen years that followed, the property owner neglected everything but the monthly check—the roof leaked like the windows, and the porch was one strong breeze from becoming a kite.

Handy and frugal, James was fixing things—a lot of things—out of his own pocket. “The owner kept putting band-aids and patching it,” he says. “I didn’t say nothing because I wanted to stay here—close to my mother, to the expressway, to public transportation. It’s a great location.” Which is why the letter announcing foreclosure arrived like a break in the clouds for James, giving him the opportunity to purchase the property from the city, if he wanted.

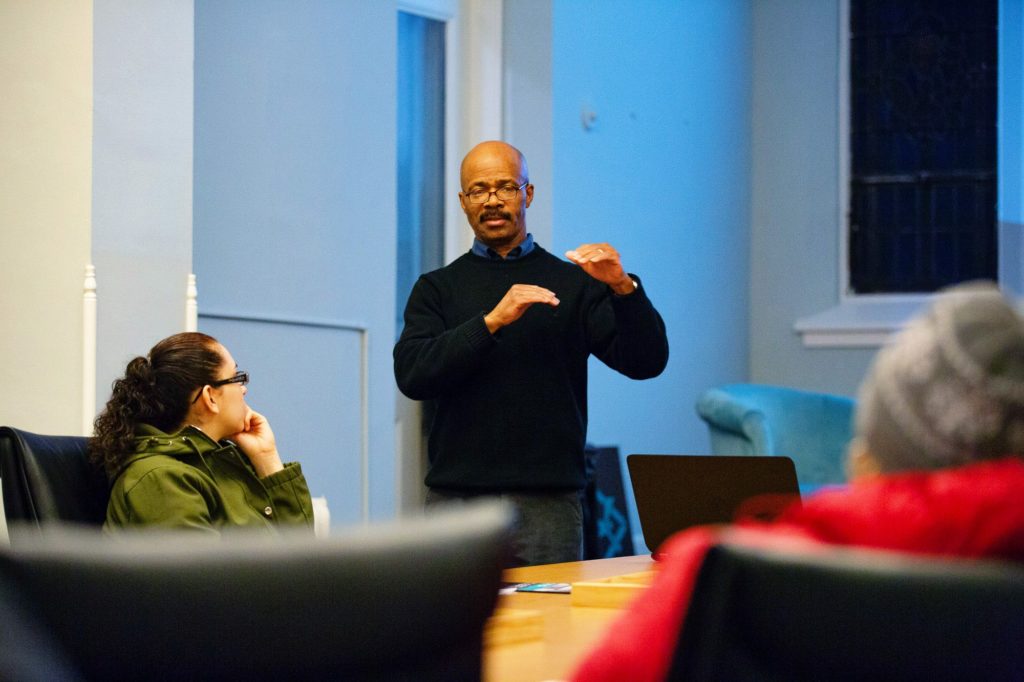

This is how he found himself at an ACTS Housing orientation one Wednesday night. James, along with a couple dozen other community members, listened as homebuyer counselor, Tony Bell, explained the ACTS model and the deal on the table, which is basically this: Through ACTS (a not-for-profit), properties valued at less than $25,000 that have been on the city’s foreclosure listing for more than 30 days can be purchased for $1,000. Those that have been on the listing for more than 60 days can be purchased for $1.

Now, there are closing and inspection costs, so at the end of the day, the total purchase price is closer to $3,500. In addition, and not surprisingly, foreclosures require significant repairs and renovations before the city will issue an occupancy permit.

“These aren’t houses you can buy for $3,500 and move in next week,” explains Tony, “No, these have got to have some serious repairs. So, this is the plan: Code, Core, Cute. The code—that’s your electrical, your plumbing, your heating. That stuff has to be done first. Then core—the doors, the roof, windows—so it’s secure. Then, you go to the cute—painting, flooring, landscaping, all that.”

Where most lenders would be looking to provide a mortgage for a move-in ready property, ACTS lends to cover the rehab costs of foreclosed properties, typically in the range of $20,000 – $50,000.

“Mine was like $24,000,” says James. “I put a new roof on the house and the garage, with new downspouts and gutters, a new porch, retiled the kitchen floor, remodeled the downstairs bathroom with new tile and toilets. I had new furnaces and water heaters put in. Last week I had Window World put in new windows downstairs…”

“I went from $550/month in rent to a $260/month mortgage—that’s $3,600 a year that stays in my pocket. That works for anybody. I can pay that off in five years if I wanted to.”

James Reynolds

2018 ACTS Homeowner of the Year

The math seems easy, but the rehab is rigorous. Each ACTS foreclosure-homebuyer works with a rehab counselor to define a scope of work and make a plan, managing the process from start to finish.

While the code-related work (namely electrical, plumbing, and HVAC) requires licensed contractors, there are many things that homebuyers can do themselves: roofing, siding, flooring, drywall patching and painting, countertop and cabinet installation, to name a few. By doing their own labor and paying only for materials, ACTS homebuyers are able to bring their costs down significantly, making homeownership affordable for many who might not be able to afford it otherwise.

James Reynolds was named the 2018 ACTS Homeowner of the Year

“You have to be so dedicated, so determined,” says Tess Wynn, a real estate agent working primarily with ACTS’ Spanish-speaking families. “It’s really impressive to me when I see people juggle working full-time, taking care of kids, and also doing some of their own work rehabbing their house. It totally blows me away. It puts into sharp perspective how strong the families who come to ACTS are. Yes, we’re helping them, but they’re doing all the work.”

“This isn’t for everybody, but it’s for most of us, you know, hard-working people,” says James.

While the monthly savings is compelling and consistent for all ACTS homebuyers, the deeper transformation is where exponential impact lies. “The science of it and the math of it all makes a lot of sense to me and that’s what always made me think this work was important,” says Executive Director, Mike Gosman, “But then you meet the families, and it seems like it’s about a lot more.”

“It’s a symbol of having made it, of being a full member of society, of being someone who’s strong and independent,” Mike continues, “And the value of that—the impact that might have on your life—might even be greater than some of the financial or mental health benefits. Just that you feel a little bit different about yourself and maybe that allows you to push a little bit harder and take on that challenging new position or start your own small business now that you’ve had some success and you feel like you can do it.”

Alongside the personal transformation, these families are solving one of Milwaukee’s most intractable challenges—bringing the city’s many blighted blocks back to life and turning destined-for-demolition liabilities into tax revenue.

Building from Blight

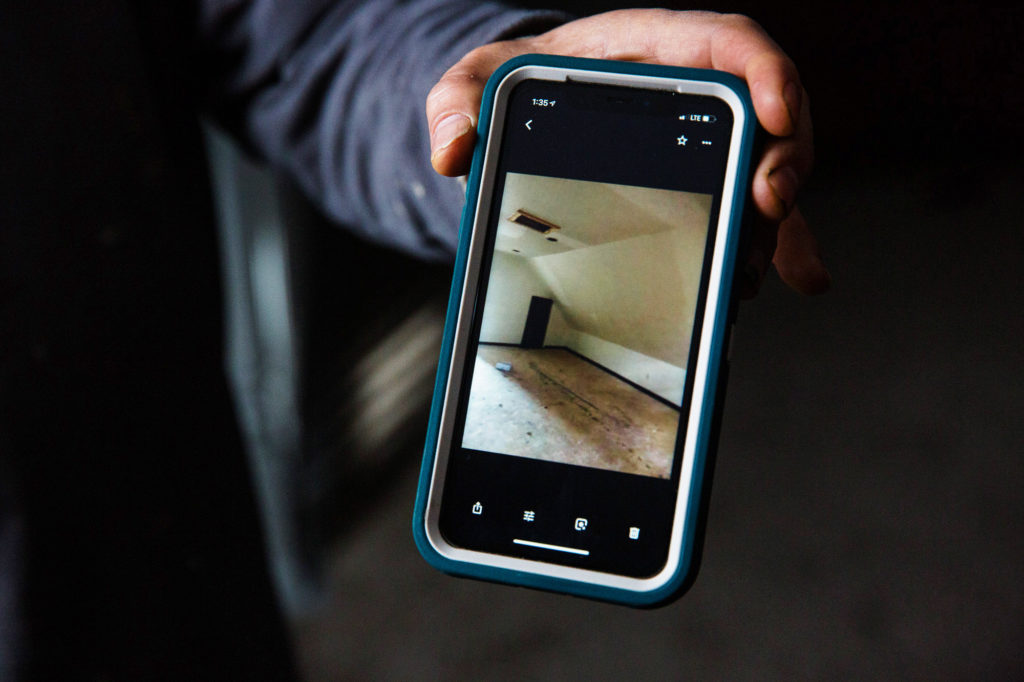

The city of Milwaukee owns at least a thousand foreclosed properties at any given time. Most of them vacant and vandalized—copper pipes and wiring stripped, and major appliances accounted for only by dust outlines on the walls.

As Senior Rehab Specialist for ACTS, Ramon Guadarrama has held the door open many times as homeowners crossed the threshold and rolled up their sleeves for the first time.

“You can see their faces when they receive the keys, they are so happy. Then we go and open the house, and it’s jaw-dropping to see the mess. Some houses are totally broken down, but they don’t care. They are cleaning. They are moving all the debris, all the broken glass with love, in a way that you start seeing the transformation of this house to the point where when they’re done, you don’t even recognize the house how it was, how it used to be,” says Ramon.

Ramon purchased his own home through ACTS nearly six years ago. “When I went to see my house the first time, I didn’t see the house as it was, I saw the house how I’d like it to be, painted the color I wanted it to be painted. I didn’t see an empty house—I saw the house with my kids and my grandkids visiting. And for me, it was good enough. I wasn’t expecting to find a brand new home,” he says.

“It gives me goosebumps every time I say it,” says Leslie Buck, an ACTS finance and homebuyer counselor, “but we’re literally bringing the life and the light back into this city one by one. The homeowners that are willing to be this kind of pioneer, this frontier person, claiming the neighborhood back—they’re very courageous.”

Before unlocking financial doors for the working poor, Leslie managed many millions for individuals with significant wealth. Today, by contrast, the couple seated across from her are going to closing with the $79 in their checking account and Friday’s payroll check.

“By being here, and by building these homes, whether it’s financially or through our rehab program, we are changing the environment of Milwaukee from one where there is a whole bunch of slum lords and rent that’s skyrocketing, to something much more stable, vibrant, and just.”

Leslie Buck

Homebuyer Counselor

“We take anybody. We don’t turn anybody away,” says Tess. “We don’t have any upper or lower income limits, we don’t have a high or low credit score.”

In orientation, Tony, too, emphasizes ACTS’ intention to make homeownership as accessible as possible, needing only six months after a bankruptcy (traditionally it’s four years), requiring six months of no late payments on credit cards (instead of twelve), offering fifteen-year mortgages (not thirty), counting consistent tithing as a source of good credit, and (hello, 2019) considering a Netflix subscription a utility.

“We want to have opportunities for home ownership for anyone who’s willing to do the work,” says Rebecca Stoner, Director of Strategic Partnerships.

“They cannot be more happy. I see them coming to pay their loan, and they are always on time. That’s another thing that we see in ACTS Housing—our portfolio is 98-99% up to date,” Ramon says.

This gets my attention: Not only is ACTS lending to those deemed high-risk and unbankable by conventional terms, but its loan portfolio is outperforming traditional banks and mortgage lenders.

“We’re not profit-driven, we’re impact-driven,” explains Rebecca, “and so the loans we make are more focused on the impact than the profit. We’re more flexible than a bank. We can adjust our regulations to meet the needs of our families. We understand that things happen. So, if a family loses a job, we’re on the phone with them talking about payment plans, or if something changes in the household, we work with our families for the first few months. If they’re owning and renting at the same time, we give a grace period while they’re doing the rehab.”

Rebecca smiles thinking of Ashley, one of the first homeowners she met when starting the job:

“She said, ‘I want to pay this loan back as quickly as possible so another family can use it.’ I was so touched by that. Not only do we have this network of homeowners, but our homeowners also have this understanding and vision of community themselves.”

Rebecca Stoner

Director of Strategic Partnerships

Mike remembers Ashley, too: “The first time I met her, she was quiet and shy and didn’t seem very confident. She worked with our team, bought a home, fixed it up and now I’ve seen her in front of a room of people sharing her story, sharing the pride that she has. It’s not just hearing someone express appreciation, it’s actually seeing she’s a different person than she was before she came to ACTS. The credit is hers—she’s just an impressive person—but I like to think that we put a support structure around her that helped provide the foundation she may have needed to take some of those next steps and blossom.”

“Home ownership is a big wealth builder. Ashley has come out of her shell and, I think, feels more confident, more successful. She probably feels more in control of what happens with her, what happens with her family, and now they will have more financial opportunities than they had in the past.”

Dorothy York

Associate Director

Power Shifting

ACTS exists to empower marginalized minorities—those boxed out of traditional lending opportunities by many factors and stiff requirements.

Take, for example, the refugee community. ACTS began in 1995 when the minister of St. Michael’s Parish came to realize the unique housing challenges faced by Hmong refugees resettled in Milwaukee after the Vietnam War. After fleeing with targets on their back for having aided American troops, these families were resettled into the cheapest housing in the hardest neighborhoods.

“The priest saw the conditions they were living in, which were deplorable,” Mike says. Families tended to be six, seven, eight members living in cramped, two-bedroom apartments, and it was expensive—especially considering the landlords weren’t taking care of the properties.

Needless to say, a single minimum-wage income with five kids and no credit history is not the profile a conventional mortgage lender is looking for, so the church had to get creative. At that time, there happened to be a lot of older parishioners in the church, many of whom couldn’t care for their homes anymore and wanted to downsize. So, the priest started connecting individuals who were aging out of their homes with refugees, once they had a few years of work under their belt.

That’s how it started, and it worked so well that in 2000, the board decided to push deeper into other marginalized communities, specifically reaching out to Latinos on the South Side and African-Americans on the North Side.

Milwaukee has been a very inhospitable place for individuals of color. The zip code 53206, which is very close to our office, is the most incarcerated zip code in the country, and there’s a long history of housing discrimination here.”

Mike Gosman

Executive Director

“We’re seeing significantly increased attendance at our orientations, and a lot of interest from the African-American community in homeownership,” says Mike. “Understanding that the experience and the challenges that an African-American family faces are different than what a refugee family might face or an immigrant family might face, the support we might need to provide might need to be a little bit different, too.”

“You’re paying for someone else to own the ‘hood, so why don’t you buy it?”

“Milwaukee is a very diverse place, but also very segregated,” adds Dorothy York, Associate Director. “We’re most concentrated in Milwaukee neighborhoods, which some people call ‘the hood.’ So we get a lot of flak back from people who say, ‘Yeah, I want to take part in your program, but I don’t want to live in the hood. And so, my thing back to them is, ‘Well, do you not live in the hood now? And the killer part is that you’re paying for someone else to own the hood, so why don’t you buy it, and you and your friends turn it into a place that used to be known as the hood. You have an opportunity here to take control of your own environment and make it what you want.”

Dorothy continues, “I like to think that we’re breaking down some of those segregation barriers, because people want to get into home ownership and the reality is they’ll have to consider some areas that they may not have thought about in the past.”

“The majority of the families I work with are immigrants—they have been kind of pushed to the side in the mortgage lending process,” explains Tess. “People come to us because we offer options for immigrants and refugees and we have staff with different language skills.”

“In the beginning, they cannot believe they are going to become homeowners. The transformation for them is amazing. It seems an impossible task, but for us, it has become our mission.”

Ramon Guadarrama

Senior Rehab Counselor

It might sound simple, but language barriers have historically kept the many refugee and immigrant communities out of the housing market. It can be an intimidating and complicated process even when you speak the language of your lender and can read the fine print.

“Home purchase is the biggest investment a lot of families are ever going to make, or at least their biggest investment to date, and so, it’s a lot to expect them to do it in a language that they’re not comfortable in,” offers Mike.

“The customers that really inspire me,” says Tess, “are the ones who would not be able to get the help and service that they receive here elsewhere because a traditional for-profit agency just wouldn’t have time for them. Their average household income is between $25,000 and $50,000, and their max purchase price is $10,000.”

ACTS is the only licensed nonprofit brokerage in Wisconsin, which is why they are able to provide real estate services that many people with barriers to homeownership can’t get elsewhere.

“We believe in the power of home ownership. If we can shift our power and our resources to support you, then that creates a more equitable Milwaukee. It’s never been about ACTS coming in and telling people what to do; it’s always been about giving people the power and the resources to do for themselves what they’ve always wanted to do.”

Rebecca Stoner

Director of Strategic Partnerships

The Multiplier Effect

“Even in the blocks where maybe we’ve only touched one or two homes,” says Mike, “the strength of those families has a huge impact—not only on their block, but on that family’s relatives, friends, and networks. Where people see, ‘Oh, homeownership is possible, and it’s possible for people who look like me, earn like me, and have had the same experiences in life that I’ve had.’ Every single transaction has this multiplier effect.”

Jose “Ruben” Delgado is a great example. He owns his own construction company, American Dream Home Improvements, and was introduced to ACTS by a friend who had gone through the process. Ruben got the $3,500 deal, which has enabled him to lower his monthly housing costs by $400. As a general contractor, the paperwork was far more intimidating than the rehab: “When the time came for the construction, that was easy. I changed everything—new electrical, plumbing, bathroom, kitchen, flooring, paint, doors. Lots of work, but that was the easiest thing. The difficult part for me was to find the house and file all the paperwork.”

He’d gone to see numerous houses with his realtor, Jenean Shorter, and worked with Ramon to create the rehab scope of work. From offer to acceptance to inspection to closing, the whole process took only 25 days. And then he spent the next four months devoted to renovations, working twelve hours a day, seven days a week.

“This was one of the fastest houses rehabbed until now,” says Ramon, “which is more amazing since he was only an army of one. It’s amazing what he has done by himself.”

“I’m part of the neighborhood, or they are part of me,” says Ruben. “This house is going to be mine forever. My kids, they need to know how to work for their homes. I’m going to help them, of course, but they need to work for their own houses. No one gets anything for free.”

Jose “Ruben” Delgado

ACTS Homeowner

“What happens, organically, is a family will come to a block, and their cousin or their best friend will say, ‘Wow, you got this home so affordable—how did you do it?’” explains Rebecca. “And they’ll say ‘Go to ACTS.’ Or a home down the street will go into foreclosure, and they’ll say, ‘Oh, we’ve got to get another ACTS homeowner in that house,’ because they want their block to be safe and stable.”

“So our part is trying to get someone to want the house that is vacant and not been taken care of anymore and putting some love back into it, like what Ruben did because this is amazing,” says Ramon.

“Our homeowners actually acknowledge that they belong to a community, a block. At ACTS Housing, that is what we do—we start with a family and we build a community.”

Ramon Guadarrama

Senior Rehab Specialist

Rippling Fast

Leslie remembers when one homeowner bought a few years ago, the whole block was foreclosed homes. “She got everything done right before Christmas,” Leslie tells me, “and she didn’t have any money left because she spent it all on the house. So, instead of buying Christmas lights, she put her favorite candles up on the window sill to be festive. At the time, her window was the only lit window on her block. Well, the next year came around and there were two other houses lit up, and then the next year she had to take a picture and she showed us—most of the houses on the street were lit back up.”

“Once we’ve proven we can do it in cities the size of Milwaukee and Beloit, there’s no reason why we can’t begin exploring how to share the model in dozens of other places. So, we’re going to be busy the next five years,” says Mike.

“If we can demonstrate that we can successfully lend larger amounts of money, there’s a huge potential to help many, many, many more families—hundreds more families who are purchasing these distressed homes and fixing them up. That’s our responsibility that we have, and we help them get that done,” says Mike.

“We believe in the power of home, and we believe that home ownership has opportunity to revitalize and transform Milwaukee’s neighborhoods,” said Rebecca Stoner

“A large number of people are of the belief that they’d never be able to achieve home ownership,” says Dorothy. “Some of them think, ‘Well, I’ll go there and five years from now I might buy a house.’ Then when they are buying a house in a month, or a few months, they’re like, ‘Wow that was fast! And who knew that it could happen for me like that.’”

“As long as a house is in foreclosure, there’s still the potential that somebody can see that house as their own. I just send that invitation—that if you need a house, come and take a look. Probably that house is going to be for you,” says Ramon.

“I was leery of ’em,” admits James. “There’s just got to be a catch, something is wrong here. I’m waiting to see what. You know they say if it’s too good to be true, it usually is, but it wasn’t. It was perfect. I’m still waiting for the catch.”

James Reynolds

2018 ACTS Homeowner of the Year